are campaign contributions tax deductible in 2019

According to OPM you can deduct even if you take the standard deduction and do not itemize. People everywhere from radio blurbs to posts.

In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates.

. As circularized in Revenue Memorandum Circular 38-2018 and as reiterated in RMC 31. The May 2019 elections are fast approaching. Taxability of election contribution.

In relation to this RMC 38-2018 provides that only those donationscontributions that have been utilizedspent during the campaign period as set by the Comelec are exempt. OPM sent out a message that states. You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund.

State and local sales tax and other deductible taxes. The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year. Its only natural to wonder if donations to a political campaign are tax deductible too.

If you made a contribution to a candidate or to a political party campaign or cause you. The answer is no. WRONG for 2020.

According to OPM you can deduct even if you take the standard deduction and do not itemize. You cannot deduct expenses in support of any candidate running for any office even if you are spending money on. Special 300 Tax Deduction.

As circularized in Revenue Memorandum Circular RMC 38-2018 and as reiterated in RMC 31-2019 campaign contributions are not included in the taxable income of the. Are campaign contributions tax deductible in 2019. You can obtain these publications free of charge by calling 800-829-3676.

On March 22 2019 the Offshore Private Banking Campaign was announced. Generally a taxpayer is allowed a deduction for any charitable contribution that is made during the tax year. In Minnesota a registered voter can claim a Political Contribution Refund equal to her donation to a state-level candidate or Minnesota political party up to 50.

However starting in 2019 for the 2018 tax year the IRS raised the limit on charitable. According to the IRS the answer is a very clear NO. The answer is no political contributions are not tax deductible.

While you cant write off. You may deduct charitable contributions of money or property made to qualified organizations if you. While tax deductible CFC deductions are not pre-tax.

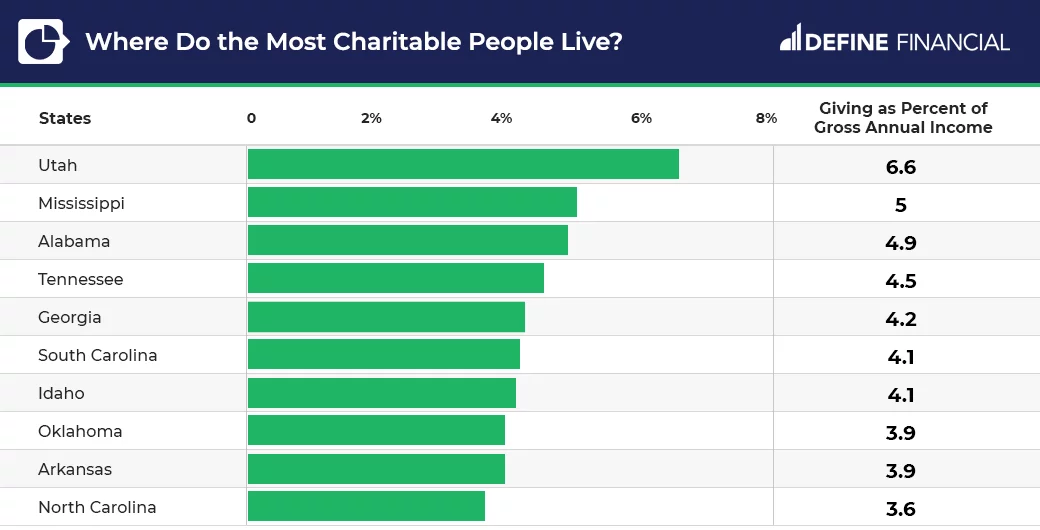

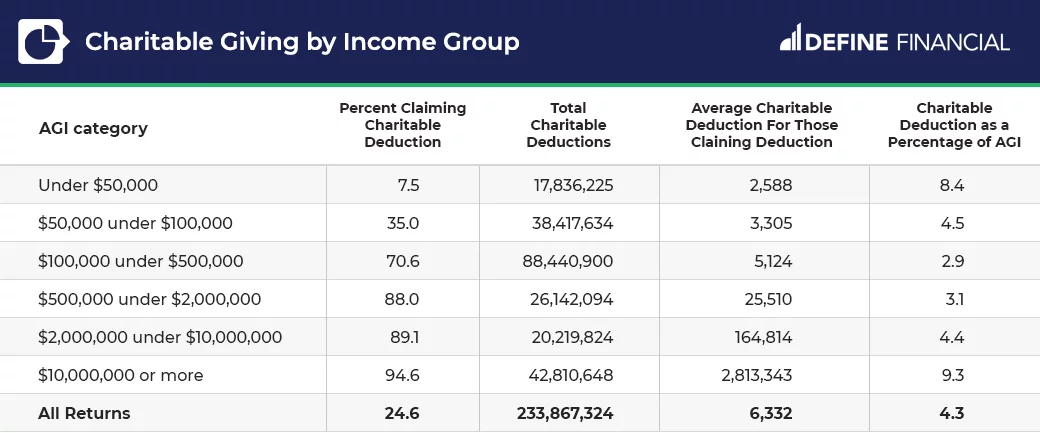

80 Charitable Giving Statistics Demographics 2022

Ask The Tax Whiz Should Candidates Parties Campaign Donors Pay Taxes

80 Charitable Giving Statistics Demographics 2022

Doing Business In The United States Federal Tax Issues Pwc

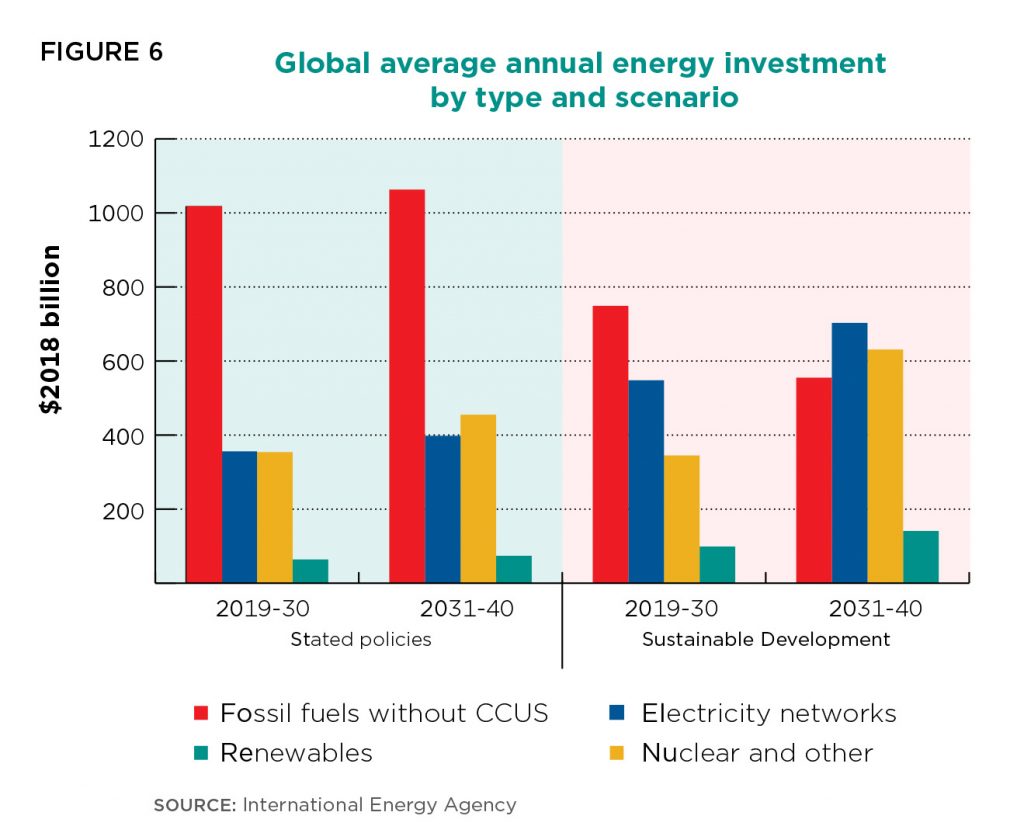

The Role Of Oil And Gas Companies In The Energy Transition Atlantic Council

Supreme Court Eyes Rich Activists Their Anonymous Donations And Tax Breaks Npr

What Would Brian Dahle Do As California Governor Calmatters

Are Political Contributions Tax Deductible H R Block

Ask The Tax Whiz Should Candidates Parties Campaign Donors Pay Taxes

House Proposes Massive Tax Cuts For Wealthiest Slashing State Revenues Bill Analysis House Bill 1437 Lc 43 2318s Georgia Budget And Policy Institute

We Thank Each And Every One Of You Who Have Been A Part Of Our Contribution And Has Helped Make This Campaign A Success T You Better Work No Response Thankful

Delegate Marlon Amprey Marlonamprey Twitter

Ask The Tax Whiz Should Candidates Parties Campaign Donors Pay Taxes

Are Political Contributions Tax Deductible H R Block

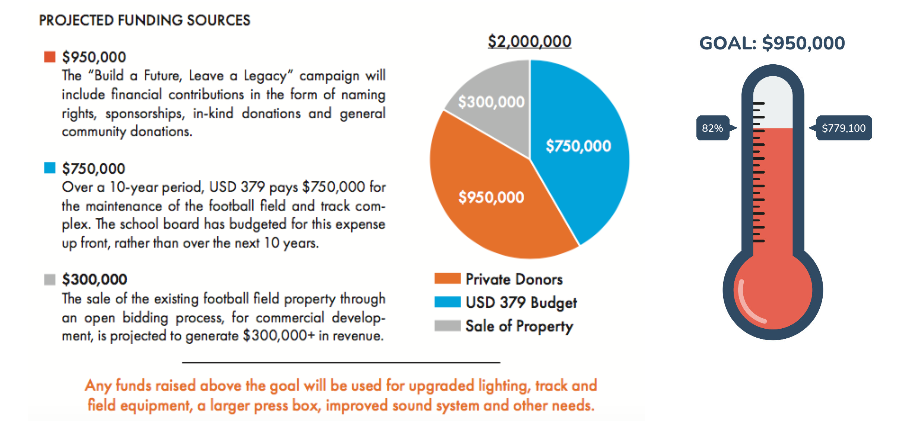

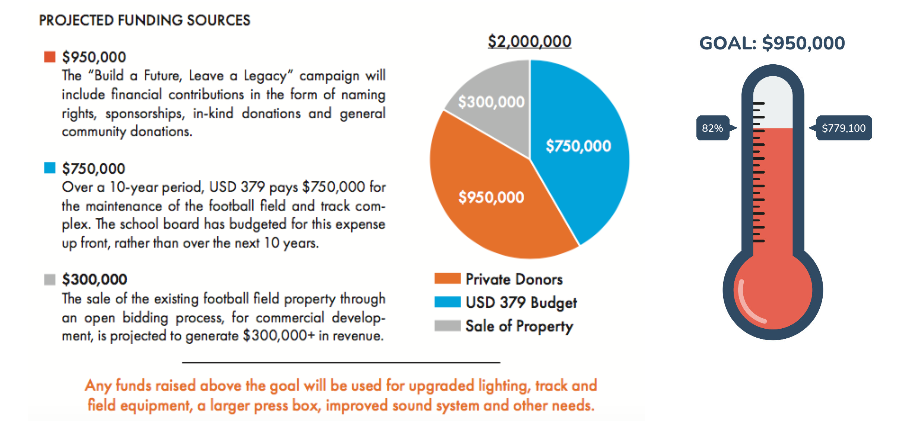

Build A Future Leave A Legacy Clay County Usd 379